Title loans, despite their appeal as quick cash solutions, carry significant default risks. However, empowering borrowers with title loan educational resources can significantly mitigate these hazards. This article explores the critical interplay between education and title loans, delving into how informed decisions can reduce default rates. We examine strategies focusing on transparent understanding of loan terms, financial literacy, and responsible borrowing practices, ultimately fostering a healthier lending ecosystem.

- Understanding Title Loans and Their Risks

- The Role of Educational Resources in Mitigation

- Strategies to Reduce Default Rates Effectively

Understanding Title Loans and Their Risks

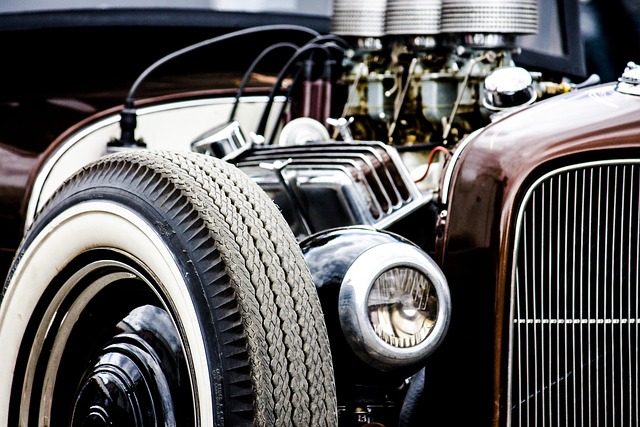

Title loans are a form of secured lending where individuals use their vehicle’s title as collateral to borrow money. While they can provide quick access to cash, understanding the risks associated with these loans is crucial. Many borrowers in Fort Worth Loans aren’t fully aware of the potential consequences, leading to default and repossession of their vehicles.

Educational resources focused on title loans can mitigate these risks by equipping borrowers with knowledge about loan terms, interest rates, and repayment options. Learning about alternatives like loan refinancing or debt consolidation can also help individuals make informed decisions. By understanding the intricacies of title loans, Fort Worth residents can avoid financial pitfalls and explore safer borrowing options to meet their short-term cash needs.

The Role of Educational Resources in Mitigation

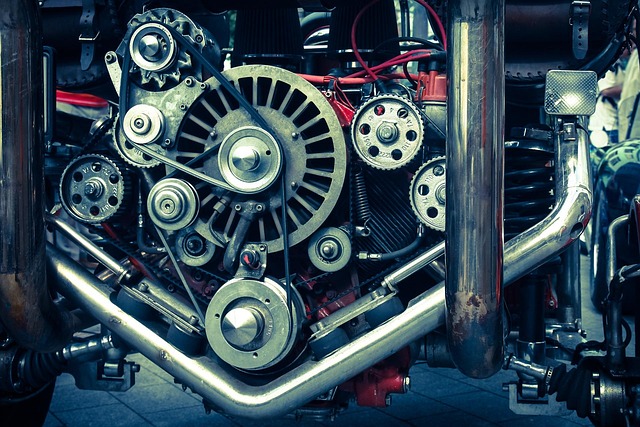

Educational resources play a pivotal role in mitigating the default risk associated with title loans. By equipping borrowers with knowledge about financial management, loan terms, and repayment strategies, these resources empower individuals to make informed decisions. Understanding the intricacies of a title loan, including interest rates, fees, and potential penalties for late payments, can prevent borrowers from overextending themselves or falling into a cycle of debt.

Furthermore, educational materials on budgeting techniques, credit score improvement, and alternative financial options help borrowers navigate their financial challenges effectively. Access to such resources encourages individuals to opt for more manageable payment plans and explore flexible payment structures offered by lenders, thereby reducing the likelihood of defaulting on their loans.

Strategies to Reduce Default Rates Effectively

One effective strategy to reduce default rates on title loans is through comprehensive title loan educational resources. Equipping borrowers with knowledge about the terms, conditions, and implications of their loans can significantly lower the risk of default. These educational materials should cover key aspects such as interest rates, repayment schedules, and potential penalties for late payments. By empowering individuals to make informed decisions, they are more likely to manage their loans responsibly.

Moreover, Houston Title Loans can benefit from implementing loan extension options as a risk mitigation measure. Flexible repayment terms and the ability to extend loans provide borrowers with a safety net during unforeseen financial challenges. This approach not only shows goodwill but also ensures that borrowers stay on track without incurring additional penalties. As a financial solution, this strategy promotes long-term customer satisfaction and loyalty, thereby reducing default rates.

Title loan educational resources play a pivotal role in reducing default risk by empowering borrowers with knowledge. By understanding the intricacies of title loans and implementing effective strategies, lenders can foster responsible borrowing. These educational initiatives act as a shield against potential defaults, ensuring a more secure lending environment for all involved parties. Embracing these resources is a proactive step towards navigating the financial landscape with confidence and minimizing risks associated with title loans.